Your First Home Starts Here

Buying your first home is exciting—but it can also feel overwhelming. You’re not just choosing a place to live—you’re making one of the biggest financial decisions of your life. That’s why you deserve more than just a mortgage. You deserve a guide, an advocate, and someone who’s in your corner from day one.

I specialize in helping first-time buyers across Ontario feel confident, informed, and supported through every step of the home buying journey.

Get Approved with Confidence

Worried you might not qualify? You’re not alone. I work with all types of income and employment situations—including new careers, contract work, and student loan debt. My goal is to get you a clear approval, not just a vague pre-qualification.

Understand Your Options

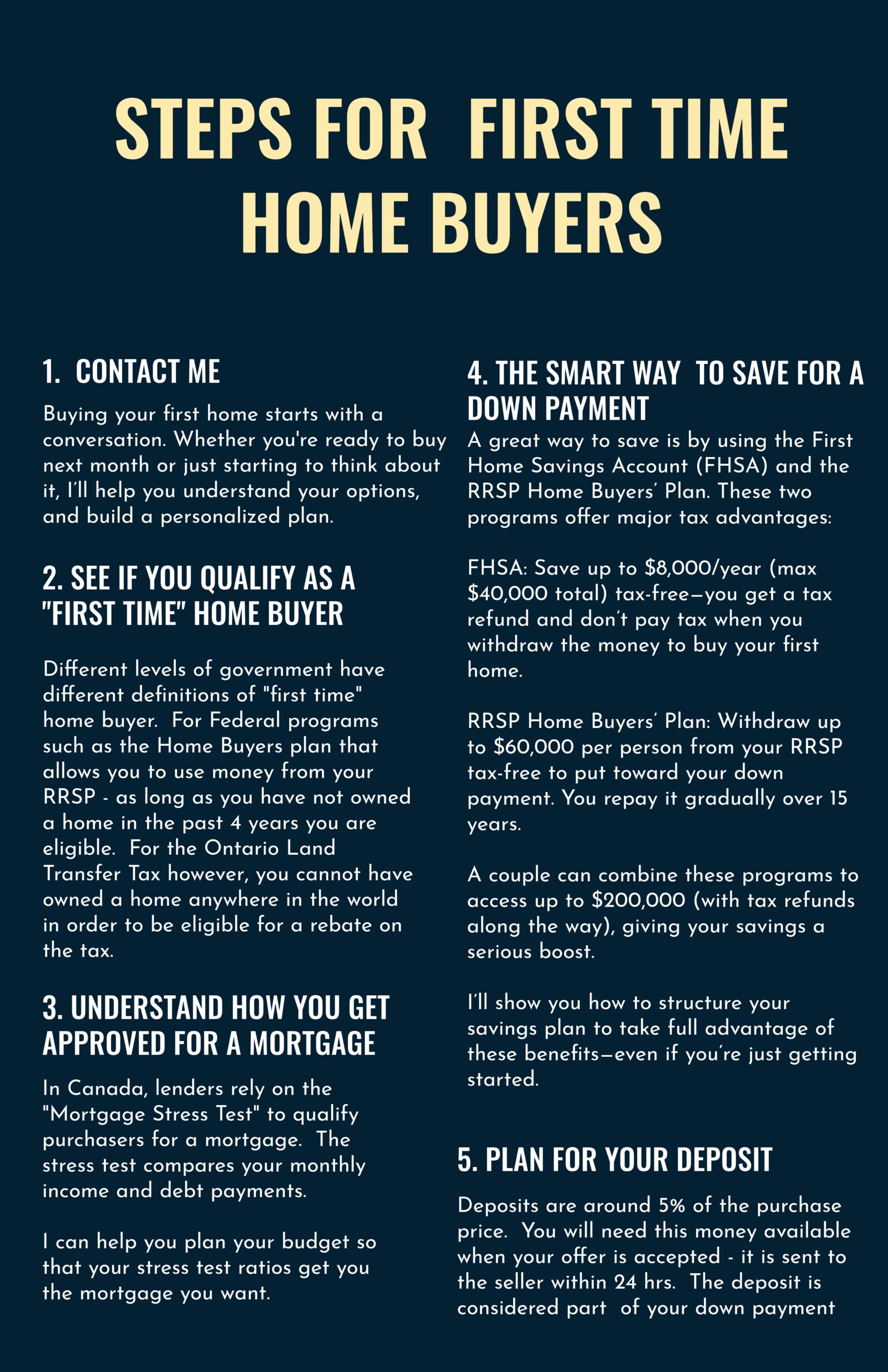

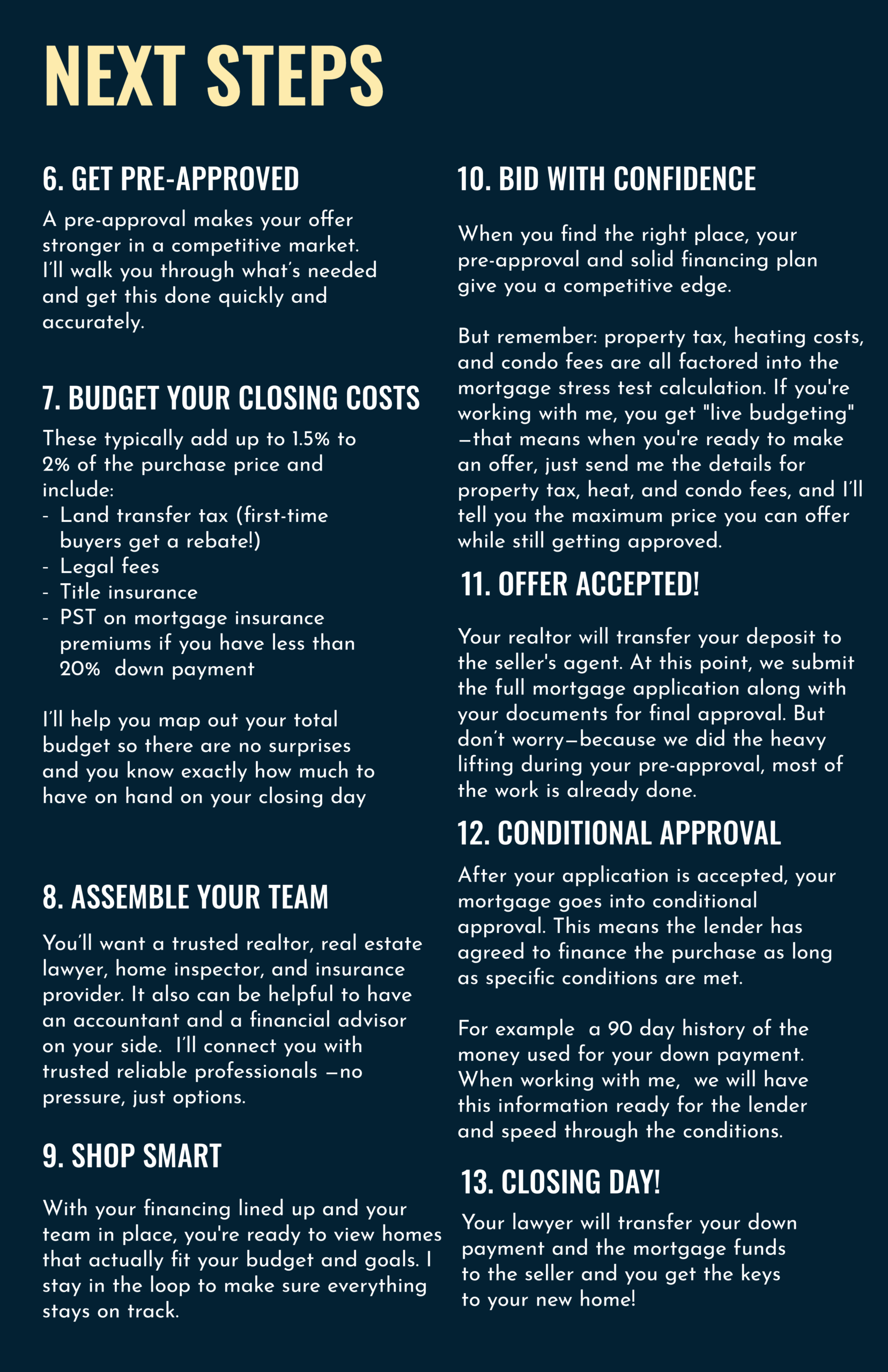

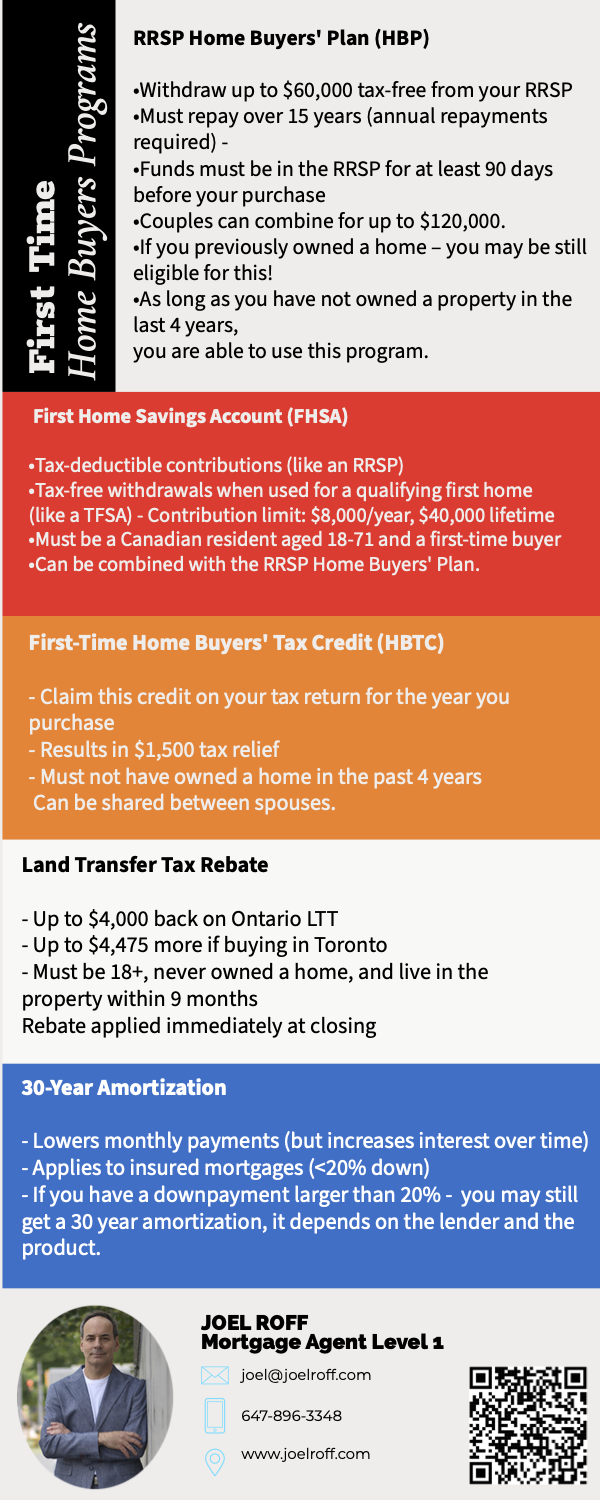

There’s no one-size-fits-all mortgage—especially for first-time buyers. I’ll walk you through fixed vs. variable, high-ratio vs. conventional, and help you access government programs like the First-Time Home Buyer Incentive and Land Transfer Tax rebates.

Real Support, Real Answers

You’ll have questions—lots of them. And I’ll be here with real answers, not just generic advice. Whether it’s late at night or over the weekend, I make sure you feel supported and never rushed.

Plan Beyond the Purchase

Your first mortgage should be the foundation of a bigger financial plan. I’ll help you choose a mortgage that fits your goals—not just for today, but five or ten years down the road.

You Don't Pay a Dime for this Service

As a first-time buyer, you already have plenty of expenses to manage—but my services are free in the vast majority of situations. I’m paid a standard commission by the lender only after your mortgage closes, and most lenders pay roughly the same amount (about 1%).

Occasionally a specialized or alternative mortgage solution comes with a broker fee. If that ever applies to your deal, I’ll spell it out in writing and answer every question before you commit—no surprises, no pressure.

Transparency is at the heart of how I work. I’ll walk you through each option clearly, so you know exactly what you’re paying (if anything) and why. As a licensed Mortgage Agent in Ontario, I follow strict professional standards—and if you ever have a concern, you can contact our regulator, the Financial Services Regulatory Authority of Ontario (FSRA).

Let's Make it Happen

If you’re ready to explore your buying power—or just want to understand what’s possible—let’s talk. There’s no pressure and no obligation. Just honest advice and a clear path forward.

Email me today and take your first step toward homeownership with confidence.

Make Your Dream of Owning a Home Come True

Get Your Personalized Home Purchase Budget in 3 Simple Steps

Ready to discover exactly how much home you can afford?

It’s easier than you think.

Here’s how it works:

Step 1: Create your secure online profile using this link: Create your profile

Step 2: Authorize a credit check when you receive our email (this makes sure you qualify for the best rates, don’t worry it won’t lower your credit score)

Step 3: Upload your T1 tax return through our secure portal

That’s it! With just these three pieces of information, I’ll create a comprehensive purchase budget with closing costs tailored specifically to you. And the best part is that it’s free with absolutely no obligations.

What you’ll receive:

Your Optimal Purchase Range – The sweet spot where you’ll qualify for the best rates available in today’s market

Your Maximum Purchase Power – The highest amount you could potentially qualify for, we are talking qualifying with major banks that won’t offer you these limits at the branch.

Definition of a First Time Homebuyer

First thing we have to do is determine if you qualify as a first time homebuyer. A first-time home buyer in Ontario is generally someone who has never owned a home before—anywhere in the world. This strict definition applies to programs like the Ontario Land Transfer Tax rebate, which requires that neither you nor your spouse have ever owned a home. However, for some federal programs like the First Home Savings Account (FHSA) or the Home Buyers’ Plan (HBP), you may still qualify as a first-time buyer even if you’ve owned a home in the past, as long as you haven’t owned a property in the last four years.

Programs for First Time Home Buyers

Steps for a First Time Home Buyer